1. Arrange students into groups. Each group needs at least ONE person who has a mobile device.

2. If their phone camera doesn't automatically detect and decode QR codes, ask students to

4. Cut them out and place them around your class / school.

1. Give each group a clipboard and a piece of paper so they can write down the decoded questions and their answers to them.

2. Explain to the students that the codes are hidden around the school. Each team will get ONE point for each question they correctly decode and copy down onto their sheet, and a further TWO points if they can then provide the correct answer and write this down underneath the question.

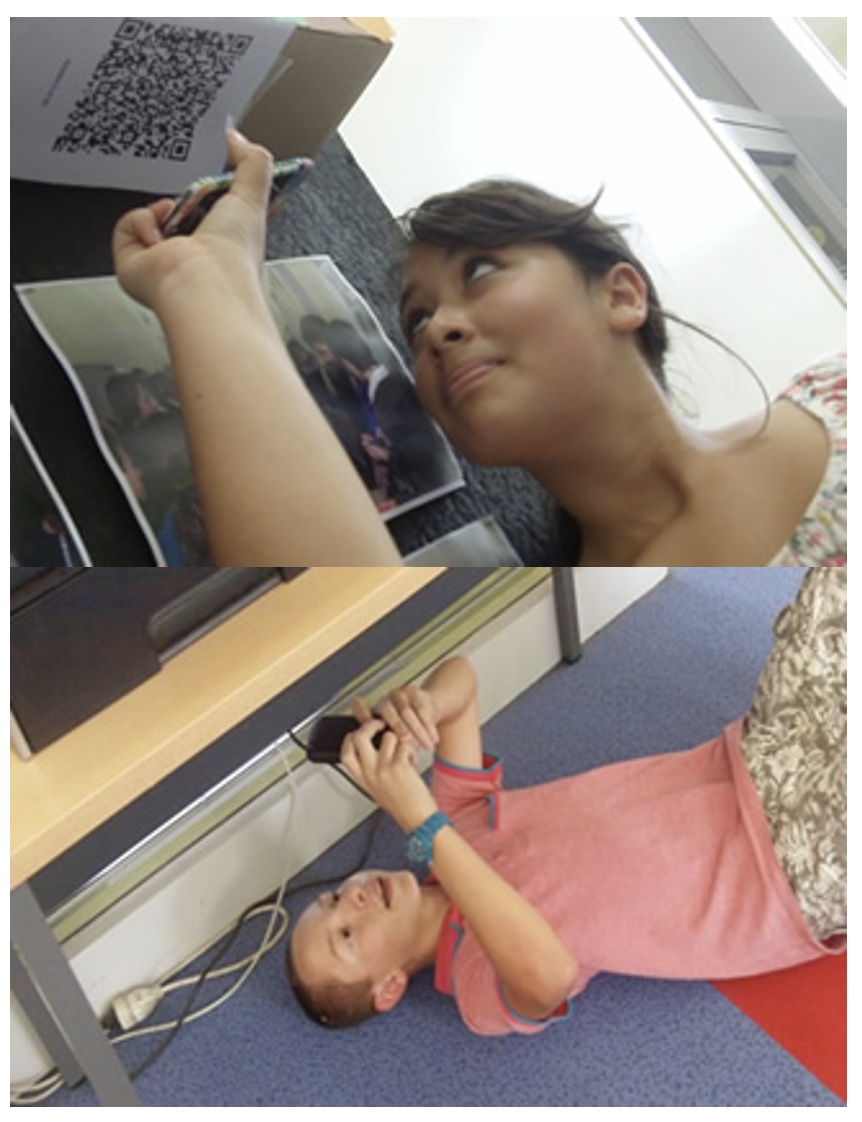

3. Away they go! The winner is the first team to return with the most correct answers in the time available. This could be within a lesson, or during a lunchbreak, or even over several days!

4. A detailed case study in how to set up a successful QR Scavenger Hunt using this tool can be found here.

Question | Answer |

| 1. A key difference between commercial banks and credit unions is that: | commercial banks are 'for-profit' and credit unions are 'not-for-profit'. | 2. Sanjay is concerned about the safety of the money in his savings account. Which type of depository institution should he choose? | He could safely choose either a commercial bank or a credit union, as long as his savings account balance meets the insurance requirements. | 3. Saving tools offered by depository institutions may earn interest. Which of the following statements is NOT TRUE about interest? | When earning interest, look for low rates. | 4. Samantha wants to be able to use funds in her checking account but finds going to the bank to withdraw cash to be inconvenient. She would like a more effective way to access her checking account funds. What would you suggest she do? | Apply for a debit card. That way she can use the card instead of cash to purchase the things she needs and the amount spent is immediately deducted from her account. | 5. Common fees that may be charged by a depository institution include all EXCEPT: | Late fee |

A key difference between commercial banks and credit unions is that:&choe=UTF-8

Question 1 (of 5)

Sanjay is concerned about the safety of the money in his savings account. Which type of depository institution should he choose?&choe=UTF-8

Question 2 (of 5)

Saving tools offered by depository institutions may earn interest. Which of the following statements is NOT TRUE about interest?&choe=UTF-8

Question 3 (of 5)

Samantha wants to be able to use funds in her checking account but finds going to the bank to withdraw cash to be inconvenient. She would like a more effective way to access her checking account funds. What would you suggest she do?&choe=UTF-8

Question 4 (of 5)

Common fees that may be charged by a depository institution include all EXCEPT:&choe=UTF-8

Question 5 (of 5)