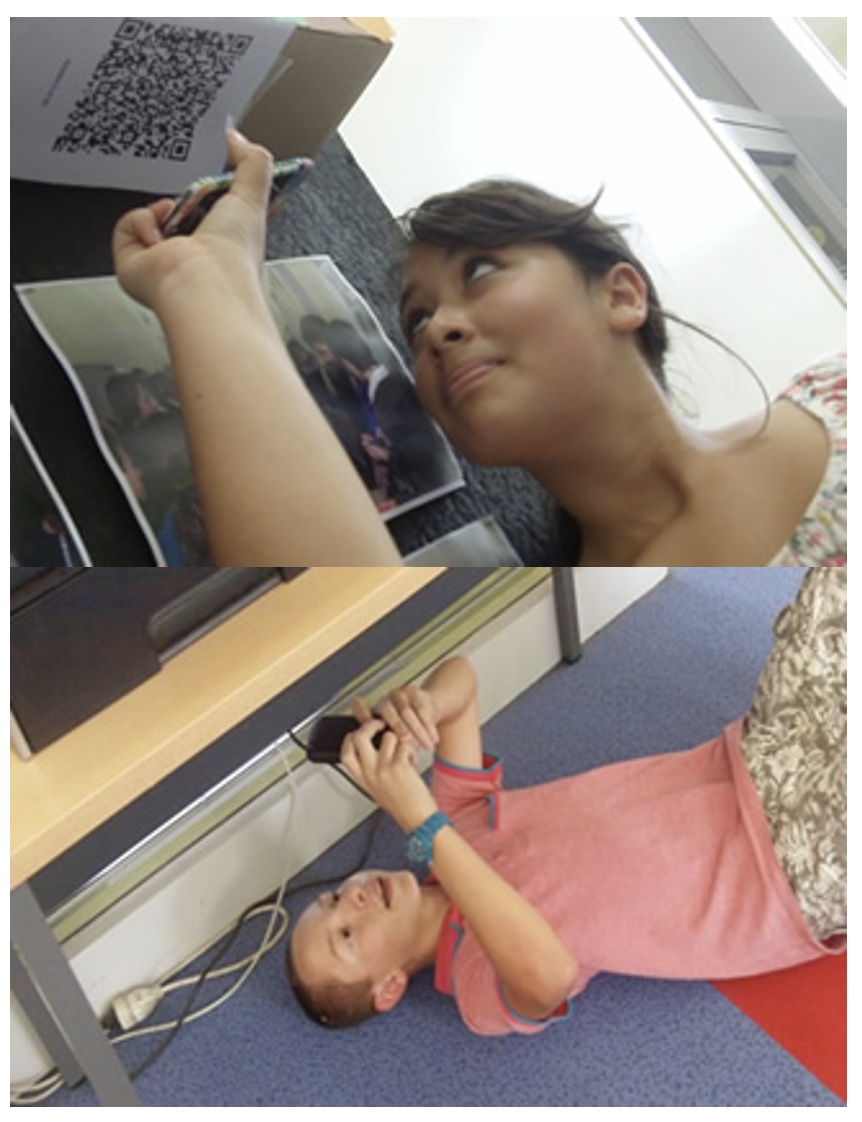

1. Arrange students into groups. Each group needs at least ONE person who has a mobile device.

2. If their phone camera doesn't automatically detect and decode QR codes, ask students to

4. Cut them out and place them around your class / school.

1. Give each group a clipboard and a piece of paper so they can write down the decoded questions and their answers to them.

2. Explain to the students that the codes are hidden around the school. Each team will get ONE point for each question they correctly decode and copy down onto their sheet, and a further TWO points if they can then provide the correct answer and write this down underneath the question.

3. Away they go! The winner is the first team to return with the most correct answers in the time available. This could be within a lesson, or during a lunchbreak, or even over several days!

4. A detailed case study in how to set up a successful QR Scavenger Hunt using this tool can be found here.

Question | Answer |

| 1. How much is the penalty that is imposed if a tax payer does not submit their return by 31 January following the end of the tax year | £100 | 2. What is the amount of the daily penalty if a tax payer is over three months late in submitting their tax return? | £10 | 3. What is the minimum amount of a penalty based on tax due that can be imposed? | £300 | 4. What is the maximum percentage penalty that can imposed on a tax payer for making a careless error | 30% | 5. What is the maximum percentage penalty that can imposed on a tax payer for making a deliberate concealed error | 30% | 6. What date would a tax payer have to make any amendments to their 2012/13 tax return by? | 31 January 2015 | 7. What date does a tax payer need to keep documentation till relating to his business for the tax year 2012/13 | 31 January 2019 | 8. The maximum penalty for falling to keep records is? | £3,000 | 9. If an AAT member suspects a client of money laundering what should they do? | Report it to the money laundering authorities | 10. A client becomes unwell and their daughter asks you to discuss your client’s affairs with her. How will you respond? | Sorry but I am unable to without a letter of authority | 11. What date do you have to inform HMRC that you have Capital gains tax to pay relating to a gain in 2012/13? | 5 October 2014 |

How much is the penalty that is imposed if a tax payer does not submit their return by 31 January following the end of the tax year&choe=UTF-8

Question 1 (of 11)

What is the amount of the daily penalty if a tax payer is over three months late in submitting their tax return?&choe=UTF-8

Question 2 (of 11)

What is the minimum amount of a penalty based on tax due that can be imposed?&choe=UTF-8

Question 3 (of 11)

What is the maximum percentage penalty that can imposed on a tax payer for making a careless error&choe=UTF-8

Question 4 (of 11)

What is the maximum percentage penalty that can imposed on a tax payer for making a deliberate concealed error&choe=UTF-8

Question 5 (of 11)

What date would a tax payer have to make any amendments to their 2012/13 tax return by?&choe=UTF-8

Question 6 (of 11)

What date does a tax payer need to keep documentation till relating to his business for the tax year 2012/13&choe=UTF-8

Question 7 (of 11)

The maximum penalty for falling to keep records is?&choe=UTF-8

Question 8 (of 11)

If an AAT member suspects a client of money laundering what should they do?&choe=UTF-8

Question 9 (of 11)

A client becomes unwell and their daughter asks you to discuss your client’s affairs with her. How will you respond?&choe=UTF-8

Question 10 (of 11)

What date do you have to inform HMRC that you have Capital gains tax to pay relating to a gain in 2012/13?&choe=UTF-8

Question 11 (of 11)