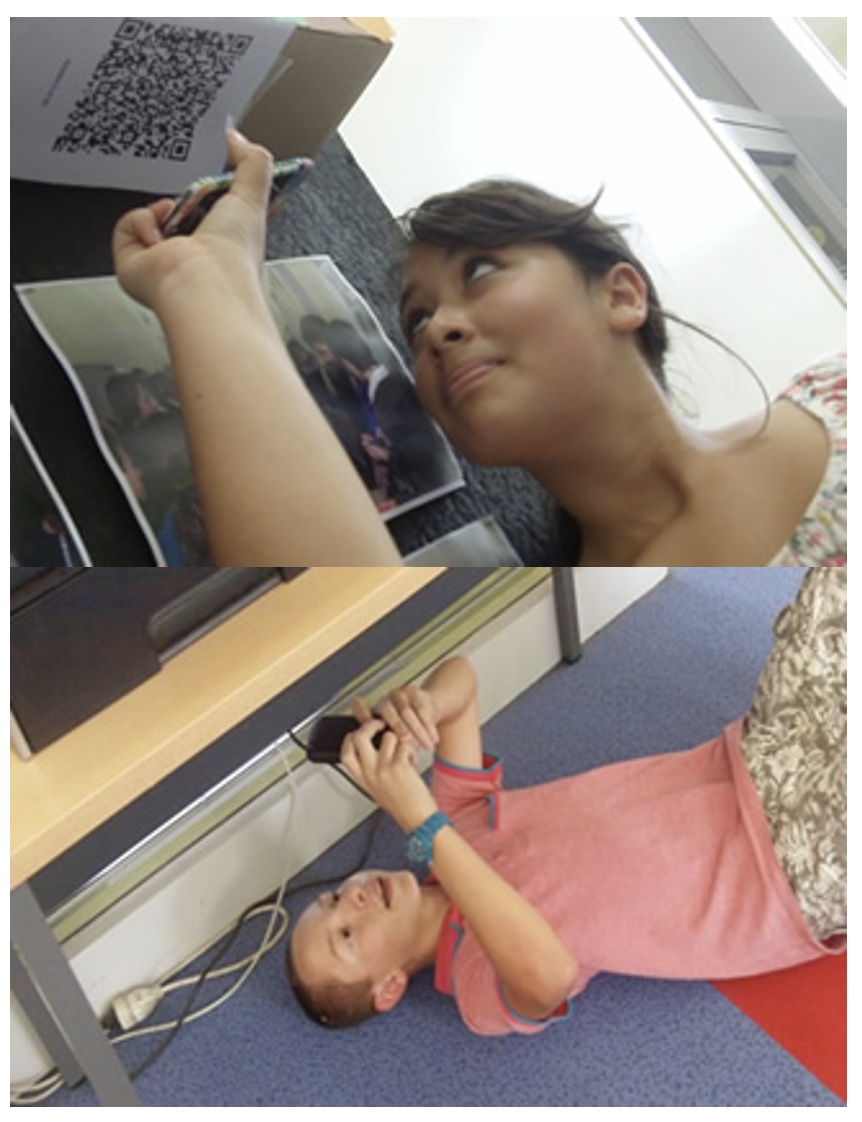

1. Arrange students into groups. Each group needs at least ONE person who has a mobile device.

2. If their phone camera doesn't automatically detect and decode QR codes, ask students to

4. Cut them out and place them around your class / school.

1. Give each group a clipboard and a piece of paper so they can write down the decoded questions and their answers to them.

2. Explain to the students that the codes are hidden around the school. Each team will get ONE point for each question they correctly decode and copy down onto their sheet, and a further TWO points if they can then provide the correct answer and write this down underneath the question.

3. Away they go! The winner is the first team to return with the most correct answers in the time available. This could be within a lesson, or during a lunchbreak, or even over several days!

4. A detailed case study in how to set up a successful QR Scavenger Hunt using this tool can be found here.

Question | Answer |

| 1. 1. What do you call the phase in which financial plans are implemented; the feedback and adjustment process required to ensure adherence to plans and modification of plans because of unforeseen changes? | Financial Control | 2. 2. What do you call the forecast of a firm's unit and dollar sales for some future period? | Sales Forecast | 3. 3. What do you call the projection of sales income, and assets based on alternative production and marketing strategies as well as the determination of the resources needed to achieve these projections? | Financial Planning | 4. 4. What do you call this method of forecasting financial requirements based on forecasted financial statements? | Projected Balance Sheet Method | 5. 5. These funds are obtained from routine business transactions. | Spontaneously Generated Funds | 6. 6. These are funds that a firm must raise exernally through borrowing or by selling new stock. | Additional Funds Needed (AFN) | 7. 7. What do you call the effects on the income statement and balance sheet of actions taken to finance forecasted increases in assets? | Financing Feedbacks | 8. 8. What do you call the assets that cannot be acquired in small increments, instead, they must be obtained in large, discrete amounts? | Lumpy Assets | 9. 9. This is an analytical technique for studying the relationship among sales revenues, operating costs, and profits. | Breakeven Analysis | 10. 10. These are operating costs that remain the same (constant) regardless of the level of production. | Fixed Operating Costs | 11. 11. What are the two types of leverage that exists in a firm? | Operating Leverage and Financial Leverage | 12. 12. This is a schedule that shows cash receipts, cash disbursements and cash balances for a firm over a specified period of time. | Cash Budget |

1. What do you call the phase in which financial plans are implemented; the feedback and adjustment process required to ensure adherence to plans and modification of plans because of unforeseen changes? &choe=UTF-8

Question 1 (of 12)

2. What do you call the forecast of a firm's unit and dollar sales for some future period? &choe=UTF-8

Question 2 (of 12)

3. What do you call the projection of sales income, and assets based on alternative production and marketing strategies as well as the determination of the resources needed to achieve these projections? &choe=UTF-8

Question 3 (of 12)

4. What do you call this method of forecasting financial requirements based on forecasted financial statements? &choe=UTF-8

Question 4 (of 12)

5. These funds are obtained from routine business transactions. &choe=UTF-8

Question 5 (of 12)

6. These are funds that a firm must raise exernally through borrowing or by selling new stock. &choe=UTF-8

Question 6 (of 12)

7. What do you call the effects on the income statement and balance sheet of actions taken to finance forecasted increases in assets? &choe=UTF-8

Question 7 (of 12)

8. What do you call the assets that cannot be acquired in small increments, instead, they must be obtained in large, discrete amounts? &choe=UTF-8

Question 8 (of 12)

9. This is an analytical technique for studying the relationship among sales revenues, operating costs, and profits. &choe=UTF-8

Question 9 (of 12)

10. These are operating costs that remain the same (constant) regardless of the level of production. &choe=UTF-8

Question 10 (of 12)

11. What are the two types of leverage that exists in a firm? &choe=UTF-8

Question 11 (of 12)

12. This is a schedule that shows cash receipts, cash disbursements and cash balances for a firm over a specified period of time. &choe=UTF-8

Question 12 (of 12)