PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

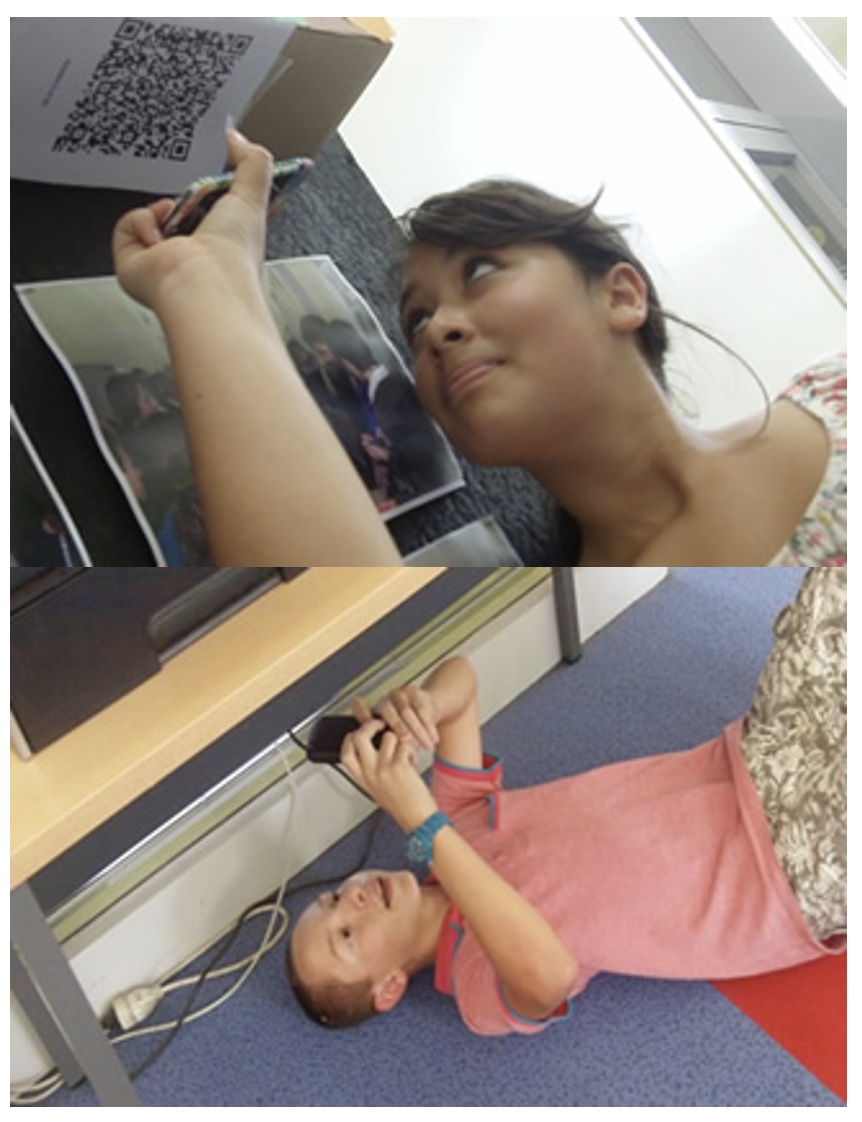

1. Arrange students into groups. Each group needs at least ONE person who has a mobile device.

2. If their phone camera doesn't automatically detect and decode QR codes, ask students to

4. Cut them out and place them around your class / school.

1. Give each group a clipboard and a piece of paper so they can write down the decoded questions and their answers to them.

2. Explain to the students that the codes are hidden around the school. Each team will get ONE point for each question they correctly decode and copy down onto their sheet, and a further TWO points if they can then provide the correct answer and write this down underneath the question.

3. Away they go! The winner is the first team to return with the most correct answers in the time available. This could be within a lesson, or during a lunchbreak, or even over several days!

4. A detailed case study in how to set up a successful QR Scavenger Hunt using this tool can be found here.

Question | Answer |

| 1. The amount of a check is written twice on each check.https://www.classtools.net/QR/16-CjYR9 | True |

| 2. An amount of cash kept on hand and used for making small payment | petty cash |

| 3. When a payment is made from the petty cash fund, a petty cash slip is prepared. True or False? | True |

| 4. A bank account from which payments can be ordered by a depositor | checking account |

| 5. A bank card that, when making purchases, automatically deducts the amount of a purchase from the checking account of the cardholder | debit card |

| 6. Banks deduct service charges from customers' checking accounts without requiring customers to write a check for the amount. True or False? | True |

| 7. Because cash transactions occur more frequently than other transactions, the chances for making recording errors affecting cash are less. True or False? | False |

| 8. A check that bank refuses to pay | dishonored check |

| 9. A check that contains errors must be marked with the word void so the others will know that it is not to be used. True or False? | True |

| 10. A check with a blank endorsement can be cashed by anyone who has possession of the check. True or False? | True |

| 11. A check with a future date on it | postdated check |

| 12. A computerized cash payments system that transfers funds without the use of checks, currency, or other paper documents | electronic funds transfer |

| 13. An endorsement consisting only of an endorser's signature | blank endorsement |

| 14. An endorsement indicating a new owner of a check | special endorsement |

| 15. An endorsement restricting further transfer of a check's ownership | restrictive endorsement |

| 16. A form showing proof of a petty cash payment | petty cash slip |

| 17. The journal entry for a payment on account using electronic funds transfer is exactly the same as when the payment is made by a check | False |

| 18. A memorandum is the source document for the entry to record establishing a petty cash fund. True or False? | False |

| 19. Most banks do not look at the date the check is written and will withdraw money from the depositor's account anytime. True or False? | False |

| 20. An outstanding check is one that has been issued by a depositor but not yet reported on a bank statement by the bank. True or False? | True |

| 21. Paid cash on account to Suburban Office Supplies using EFT. What do you debit and credit in the journal? | Debit: A/P Suburban Office Supplies & Credit: Cash |

| 22. Paid cash to establish petty cash fund. What do you debit and credit in the journal? | Debit: Petty Cash & Credit: Cash |

| 23. Paid cash to replenish a petty cash fund: $12.00; supplies, $3.50; miscellaneous expense, $8.50. What do you debit and credit? | Debit: Petty Cash, Supplies, and Miscellaneous expense Credit: Cash |

| 24. A report of deposits, withdrawals, and bank balances sent to a depositor by a bank | bank statement |

| 25. A signature or stamp on the back of a check, transferring ownership | endorsement |

| 26. The source document for a debit card purchase is a memorandum. True or False? | True |

| 27. The source document for an electronic funds transfer is a memorandum | True |

| 28. | code of conduct |

Question 1 (of 28)

Question 2 (of 28)

Question 3 (of 28)

Question 4 (of 28)

Question 5 (of 28)

Question 6 (of 28)

Question 7 (of 28)

Question 8 (of 28)

Question 9 (of 28)

Question 10 (of 28)

Question 11 (of 28)

Question 12 (of 28)

Question 13 (of 28)

Question 14 (of 28)

Question 15 (of 28)

Question 16 (of 28)

Question 17 (of 28)

Question 18 (of 28)

Question 19 (of 28)

Question 20 (of 28)

Question 21 (of 28)

Question 22 (of 28)

Question 23 (of 28)

Question 24 (of 28)

Question 25 (of 28)

Question 26 (of 28)

Question 27 (of 28)

Question 28 (of 28)