PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

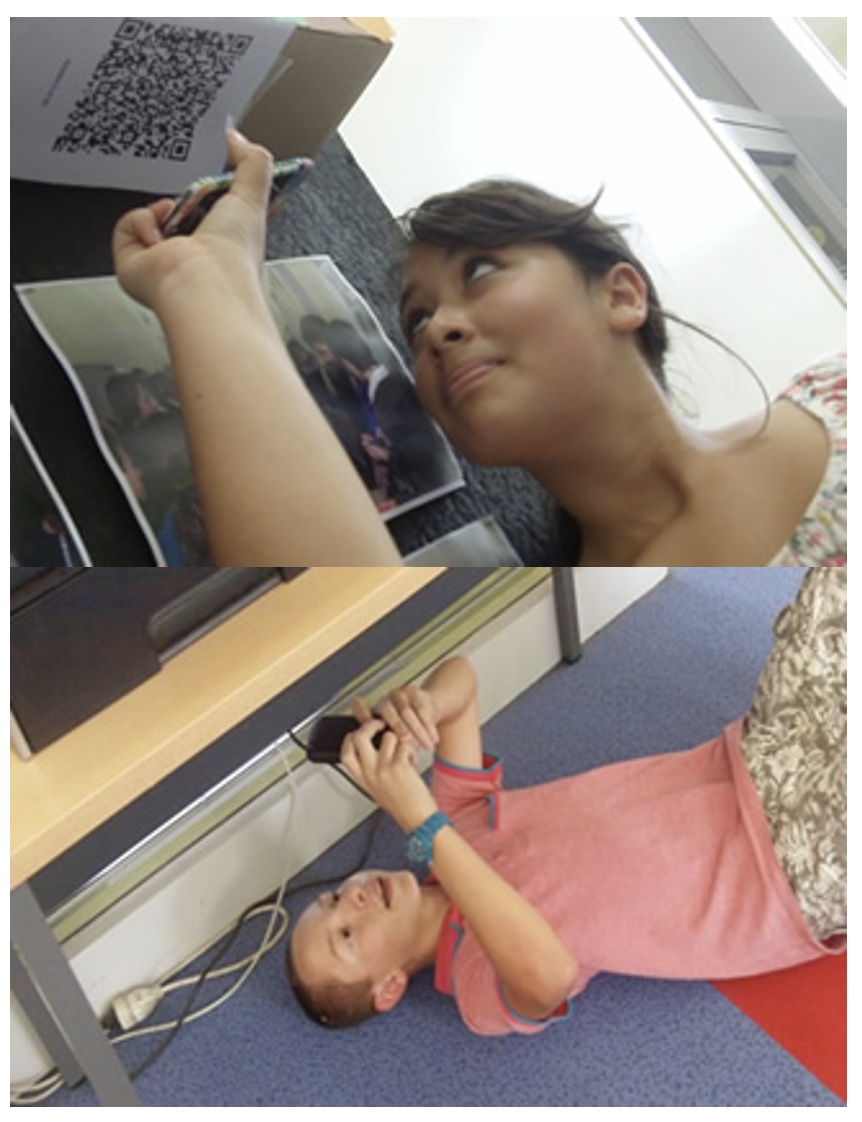

1. Arrange students into groups. Each group needs at least ONE person who has a mobile device.

2. If their phone camera doesn't automatically detect and decode QR codes, ask students to

4. Cut them out and place them around your class / school.

1. Give each group a clipboard and a piece of paper so they can write down the decoded questions and their answers to them.

2. Explain to the students that the codes are hidden around the school. Each team will get ONE point for each question they correctly decode and copy down onto their sheet, and a further TWO points if they can then provide the correct answer and write this down underneath the question.

3. Away they go! The winner is the first team to return with the most correct answers in the time available. This could be within a lesson, or during a lunchbreak, or even over several days!

4. A detailed case study in how to set up a successful QR Scavenger Hunt using this tool can be found here.

Question | Answer |

| 1. What is personal finance | all financial decisions an individual or family must make in order to earn, budget, save and spend money. |

| 2. When you assess your financial situation, what three things are you looking at | income, assets, and liabilities |

| 3. Your detailed plan for accomAplishing your financial goals is called your | budget |

| 4. People are either natural ______________ or natural _________________ | spenders and savers |

| 5. Prior to 1917, who did people get loans from? | loan sharks |

| 6. In the 1930s, what program was put in place to encourage banks to loan money? | The New Deal |

| 7. How many people live paycheck to paycheck? | 7 out of 10 |

| 8. Average credit card debt of American households? | 15,000 |

| 9. Average car loan debt? | 13,000 |

| 10. Personal finance is 80% _______________ and 20% ____________. | behavior, head knowledge |

| 11. What negative emotions do teens express about money? | stress, frustration, distrust |

| 12. Americans are told that debt is _________________ | normal |

| 13. We are taught that money can buy _________________ | happiness |

| 14. At the survival level of money, people are _____________________ | spending all of their income and then some. |

| 15. At the comfort level of money, people have ________________________ | a small surplus that you save and invest |

| 16. At the secure level of money, people are _________________________ | having their money generate income for them. |

| 17. A fee that you pay to borrow money? | Interest |

| 18. An obligation of repayment owed by one party to a second party | debt |

| 19. Debt evidenced by a note, which specifies the principal amount, interest rate and date of repayment | loan |

Question 1 (of 19)

Question 2 (of 19)

Question 3 (of 19)

Question 4 (of 19)

Question 5 (of 19)

Question 6 (of 19)

Question 7 (of 19)

Question 8 (of 19)

Question 9 (of 19)

Question 10 (of 19)

Question 11 (of 19)

Question 12 (of 19)

Question 13 (of 19)

Question 14 (of 19)

Question 15 (of 19)

Question 16 (of 19)

Question 17 (of 19)

Question 18 (of 19)

Question 19 (of 19)