PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

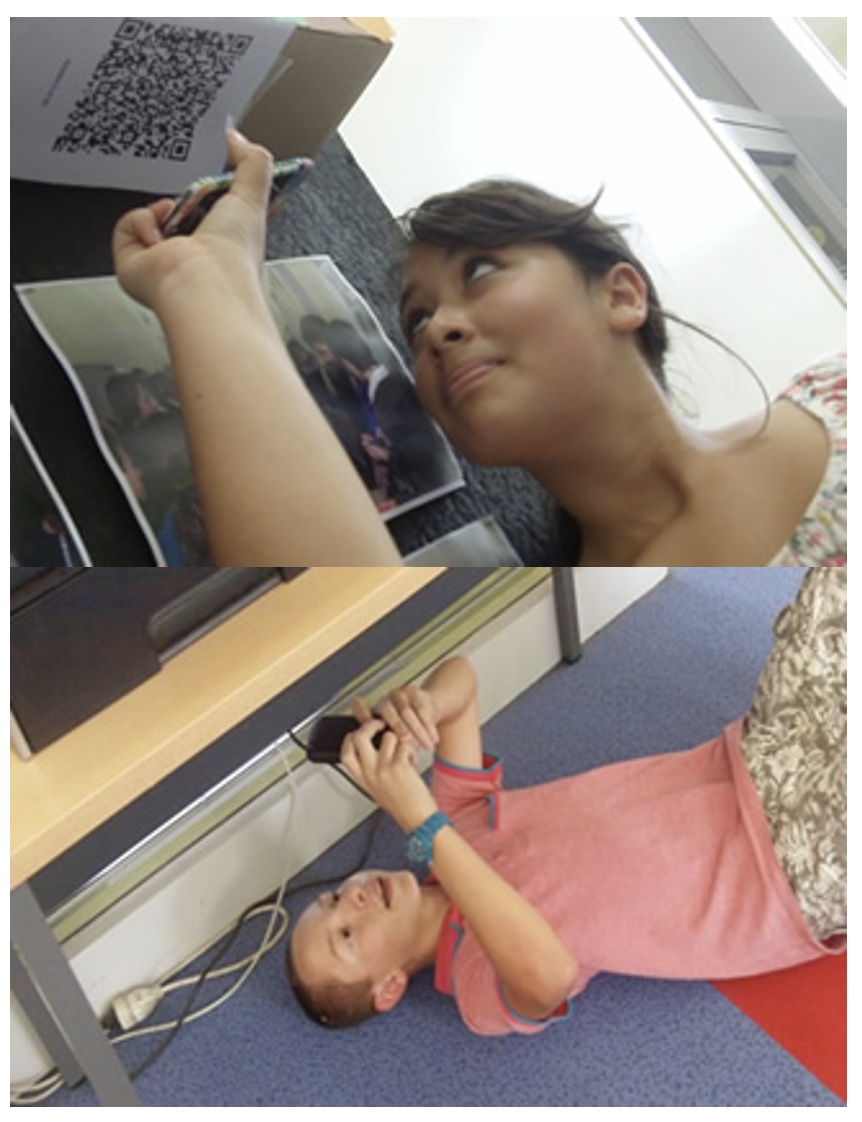

1. Arrange students into groups. Each group needs at least ONE person who has a mobile device.

2. If their phone camera doesn't automatically detect and decode QR codes, ask students to

4. Cut them out and place them around your class / school.

1. Give each group a clipboard and a piece of paper so they can write down the decoded questions and their answers to them.

2. Explain to the students that the codes are hidden around the school. Each team will get ONE point for each question they correctly decode and copy down onto their sheet, and a further TWO points if they can then provide the correct answer and write this down underneath the question.

3. Away they go! The winner is the first team to return with the most correct answers in the time available. This could be within a lesson, or during a lunchbreak, or even over several days!

4. A detailed case study in how to set up a successful QR Scavenger Hunt using this tool can be found here.

Question | Answer |

| 1. What does the acronym FAFSA stand for? | Free Application for Federal Student Aid | 2. What must you obtain before filing the FAFSA and what website can you go to obtain it? | A PIN, www.pin.ed.gov | 3. What is the CSS Financial Aid Profile? When does it need to be filed and does everyone need to complete one? | The PROFILE is an online application that collects information used by certain colleges and scholarship programs to award institutional aid funds. (All federal funds are awarded based on the FAFSA, available after Jan. 1 at www.fafsa.ed.gov.) Some colleges may require additional information, such as tax returns or an institutional application. If your parents are divorced, some colleges will also require your noncustodial parent to complete the Noncustodial PROFILE. A student will file in early October of the senior year and typically, selective colleges require the CollegeBoard's CSS Profile. | 4. What does the acronym PLUS stand for, as in a Federal PLUS loan? | Parent Loan for Undergraduate Students | 5. When does repayment begin on a Federal STAFFORD loan? | 6 months after graduation | 6. What are two different kinds of scholarships offered? | Scholarships from colleges/universities and local/national scholarships. | 7. Log onto your Naviance account and print off a scholarship application. This could be an example of a local scholarship offered through the WHS Counseling Center Office. | Answers will vary | 8. Name 2 characteristics of scholarship scams. | Name 2 characteristics of scholarship scams. | 9. Search Ball State University's Scholarships and Financial Aid website and find what an in-state freshman will receive p/year for the Presidential Scholarship. What is the 4-year total and what does the student have to do in order to maintain the scholarship? | The Presidential Scholarship is worth $4,500 and can be renewed up to 4 years for a total of $18,000. Presidential scholars must maintain a cumulative GPA of 3.0 or higher. | 10. What is the difference between grants, loans, and work study? | Grant money usually doesn't have to be repaid and is usually based on need. Loans are money you borrow and have to repay back with interest. Work Study money is earned by a student through a job on or near campus while attending school and does not have to be repaid. | 11. What is a 529 plan and how do you start one? | The 529 Education Savings program provides you with a tax-advantaged way to invest for higher education. You have to consult with a financial adviser in order to get one. | 12. What does COA stand for and give examples of DIRECT and INDIRECT COA? | Cost of Attendance. Direct COA includes tuition and fees/room and board. Indirect include books, supplies, transportation, misc. personal expenses, etc. | 13. What are Butler University's DIRECT and INDIRECT COA (or COE in their case)? | Total Direct Costs=$47,272 and Total Indirect Costs=$3,500 Total COE=$50,772 | 14. What does EFC stand for and what does it mean? | Expected Family Contribution and it is the parents' contribution from income and assets + student contribution from income and assets. | 15. Free Response Question: Have you had the “money talk” with your parents? What might this conversation look like and what is the role of your parents and of you as the student when discussing how to pay for college? | Answers will vary | 16. What does NPC stand for and why is it important to families, in terms of financial aid? | Net Price Calculators can be found on colleges/universities websites. It's intended to help families understand the out-of-pocket costs of colleges and universities. | 17. When does the FAFSA come out and when is it due? | January 1st of the Senior year and it must be received by March 10th (Indiana deadline) of that same year. Submit by March 1st to receive maximum consideration for state, federal and institutional aid. | 18. Prior to filing the FAFSA on the web, what is a worksheet you and your parents can fill out to help when completing the FAFSA online? Print this worksheet as your evidence. | FAFSA on the Web Worksheet | 19. Explain the difference between subsidized and unsubsidized Federal Stafford Loans | Subsidized=Government pays the interest while you are in school at least 1/2 time and unsubsidized=borrower is responsible for all interest. | 20. Bonus ?: Why is it important to know and follow deadlines for all of the schools to which you are applying? For example, I am a WHS Senior applying to Hope College, what is the deadline for filing the FAFSA? | It is important to know the FAFSA deadlines for each of the states where each of the colleges to which you are applying reside. For example, the FAFSA deadline for Hope College in MI, is March 1. For a college’s FAFSA deadline, check the school’s website or contact its financial aid office. |

Question 1 (of 20)

Question 2 (of 20)

Question 3 (of 20)

Question 4 (of 20)

Question 5 (of 20)

Question 6 (of 20)

Question 7 (of 20)

Question 8 (of 20)

Question 9 (of 20)

Question 10 (of 20)

Question 11 (of 20)

Question 12 (of 20)

Question 13 (of 20)

Question 14 (of 20)

Question 15 (of 20)

Question 16 (of 20)

Question 17 (of 20)

Question 18 (of 20)

Question 19 (of 20)

Question 20 (of 20)