PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

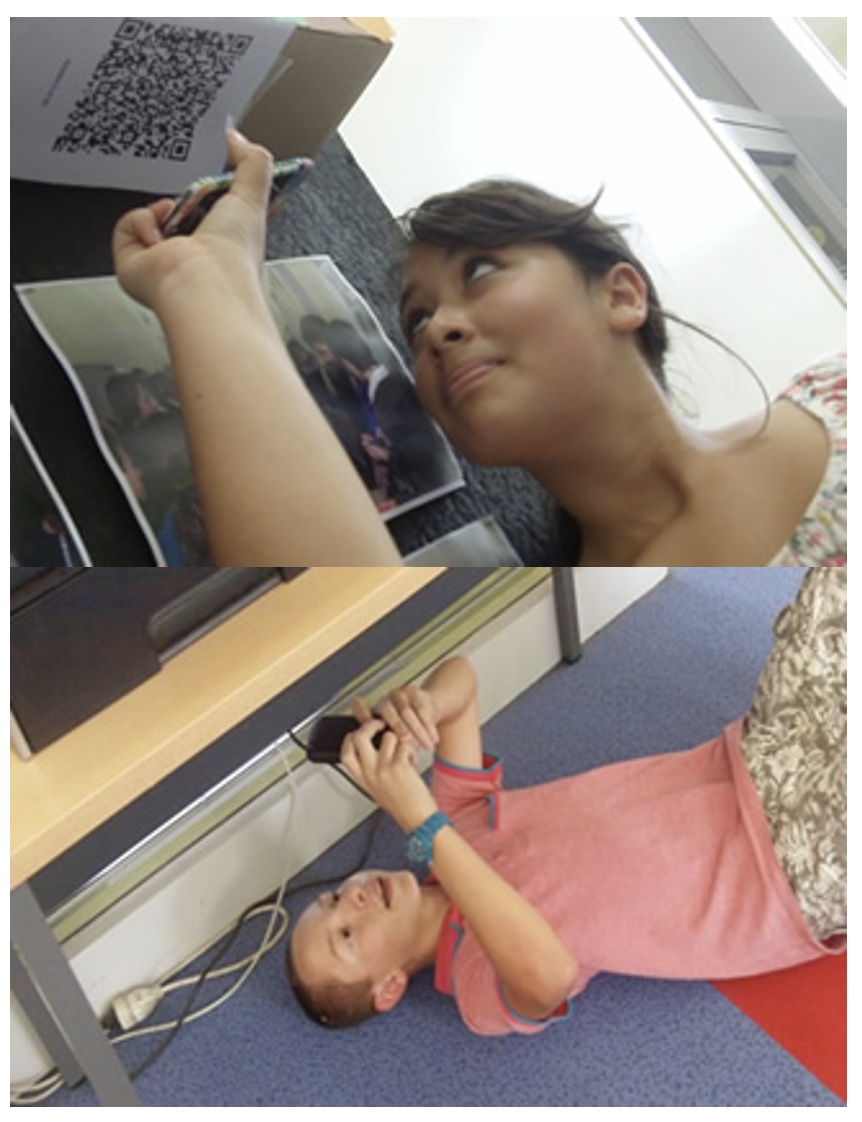

1. Arrange students into groups. Each group needs at least ONE person who has a mobile device.

2. If their phone camera doesn't automatically detect and decode QR codes, ask students to

4. Cut them out and place them around your class / school.

1. Give each group a clipboard and a piece of paper so they can write down the decoded questions and their answers to them.

2. Explain to the students that the codes are hidden around the school. Each team will get ONE point for each question they correctly decode and copy down onto their sheet, and a further TWO points if they can then provide the correct answer and write this down underneath the question.

3. Away they go! The winner is the first team to return with the most correct answers in the time available. This could be within a lesson, or during a lunchbreak, or even over several days!

4. A detailed case study in how to set up a successful QR Scavenger Hunt using this tool can be found here.

Question | Answer |

| 1. Pay received for hourly work is | wages | 2. Fixed amount of pay for a certain period of time. | salary | 3. Pay that is a percentage of the total amount sold by a salesperson. | commission | 4. Pay that is 1.5 times more than the hourly rate. | overtime | 5. Advancement to a higher position in a company. | promotion | 6. Increase in a worker's pay. | raise | 7. Rate of pay for each item produced. | piecework or piece rate | 8. Vacations, paid holidays, paid sick leave, etc. that an employer offers in addition to salary. | fringe benefits or perqs | 9. Pay before taxes and deductions. | gross pay | 10. Pay after taxes and deductions. | net pay | 11. Raises employees may receive to try to keep up with inflation. | Cost of living-CoLa | 12. A bonus an employee might receive that is not tied to sales or productivity. | signing bonus | 13. Pay an employee might receive if a company is profitable. | bonus | 14. Opportunity for an employee to purchase share of stock of their company. | stock options | 15. Two of the four areas regulated by the Fair Labor Standards Act. | minimum wage and overtime | 16. What is the pay for 43.5 hours of work at $8.25/hour (overtime is 1.5). | $373.31 | 17. What is the commission on the following: 6% commission on sales of $34,000? | $2040 | 18. What is the pay for 29.75 hours of work at $7.25/hour? | $215.69 | 19. What three pieces of information should be left on voice mail or text when reporting an absence to the teacher/coordinator. | name, class, reason for absence | 20. Social Security tax and Federal Withholding tax are voluntary deductions. | False | 21. The cost of an employee to an employer is based strictly on their hourly wage. | False | 22. The Fair Labor Standards Act is a major federal law that regulates several areas of work. | True | 23. In some situations an employer can pay less than minimum wage. | True | 24. A garnishment is a voluntary deduction. | False | 25. A person that is paid semi-monthly, twice a month, will receive 26 paychecks. | False | 26. The portion of health insurance paid by an employee is considered a voluntary deduction. | true | 27. By law you are guaranteed breaks, holiday pay and paid vacations. | False | 28. The amount of the paycheck should be the only consideration of a career. | False |

Question 1 (of 28)

Question 2 (of 28)

Question 3 (of 28)

Question 4 (of 28)

Question 5 (of 28)

Question 6 (of 28)

Question 7 (of 28)

Question 8 (of 28)

Question 9 (of 28)

Question 10 (of 28)

Question 11 (of 28)

Question 12 (of 28)

Question 13 (of 28)

Question 14 (of 28)

Question 15 (of 28)

Question 16 (of 28)

Question 17 (of 28)

Question 18 (of 28)

Question 19 (of 28)

Question 20 (of 28)

Question 21 (of 28)

Question 22 (of 28)

Question 23 (of 28)

Question 24 (of 28)

Question 25 (of 28)

Question 26 (of 28)

Question 27 (of 28)

Question 28 (of 28)