PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

PREMIUM LOGIN

ClassTools Premium membership gives access to all templates, no advertisements, personal branding and many other benefits!

| Username: | ||

| Password: | ||

|

Submit

Cancel

|

||

| Not a member? | ||

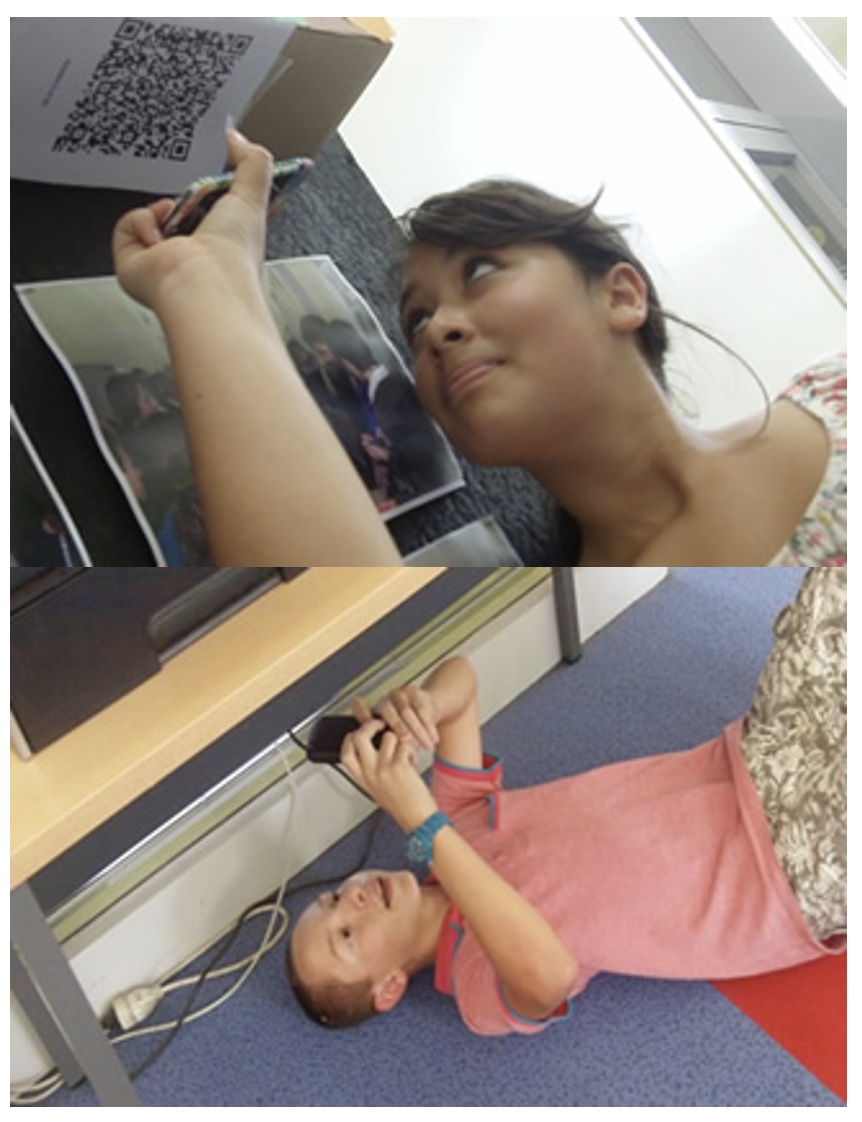

1. Arrange students into groups. Each group needs at least ONE person who has a mobile device.

2. If their phone camera doesn't automatically detect and decode QR codes, ask students to

4. Cut them out and place them around your class / school.

1. Give each group a clipboard and a piece of paper so they can write down the decoded questions and their answers to them.

2. Explain to the students that the codes are hidden around the school. Each team will get ONE point for each question they correctly decode and copy down onto their sheet, and a further TWO points if they can then provide the correct answer and write this down underneath the question.

3. Away they go! The winner is the first team to return with the most correct answers in the time available. This could be within a lesson, or during a lunchbreak, or even over several days!

4. A detailed case study in how to set up a successful QR Scavenger Hunt using this tool can be found here.

Question | Answer |

| 1. A practice or arrangement by which a company or government agency provides a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a premium. | Insurance |

| 2. Oversees insurance dealing in the state of Utah. | Utah State Insurance Department |

| 3. A person who sells insurance for one or more companies. | Insurance Agent |

| 4. A person an insurance company hires to settle claims. | Claims Adjuster |

| 5. The policyholder or person(s) protected in case of a loss/claim. | Insured |

| 6. The insurance company. | Insurer |

| 7. A basic requirement for an insurance company to issue a policy. Entities not subject to financial loss from an event cannot purchase an insurance policy to cover that event. | Insurable Interest |

| 8. The contract form issued by the company to explain the coverage provided. It is a legal document. | Policy |

| 9. Amendments to the policy used to add, change, or delete coverage. Also referred to as a "rider." | Riders/Endorsements |

| 10. The price charged for insurance. | Premium |

| 11. The amount you agree to pay on each loss before your insurance company pays. | Deductible |

| 12. Your request for the insurance company to pay you an amount under the terms of your policy for a covered peril. | Claim |

| 13. Generally, a beneficiary is a person who receives benefit from a particular entity (say trust) or a person. | Beneficiary |

| 14. An estimate of damages you provide to an insurance company to support your claim. Insurance companies often use this document to figure how much they will pay. | Proof of Loss |

| 15. After negotiating, the amount you agree to accept from the insurance company as full payment for your loss. | Settlement |

| 16. any act committed with the intent to obtain a fraudulent outcome from an insurance process. | Insurance Fraud |

Question 1 (of 16)

Question 2 (of 16)

Question 3 (of 16)

Question 4 (of 16)

Question 5 (of 16)

Question 6 (of 16)

Question 7 (of 16)

Question 8 (of 16)

Question 9 (of 16)

Question 10 (of 16)

Question 11 (of 16)

Question 12 (of 16)

Question 13 (of 16)

Question 14 (of 16)

Question 15 (of 16)

Question 16 (of 16)